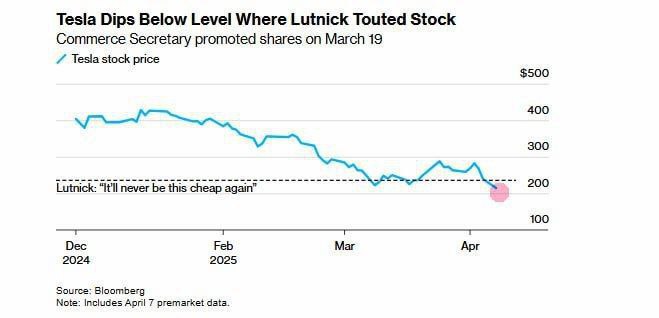

Tesla securities fell to $214.80, surpassing the level previously called "unreachably low" by US Secretary of Commerce Howard Lutnick, writes Bloomberg.

The drop is associated with global economic difficulties and trade measures by the Trump administration, as well as Elon Musk's involvement in political conflicts. "It's hard to underestimate the negative reaction to Trump's tariff policy in China and the US president's connection with Musk. This will further push Chinese consumers to buy domestic products," said Wedbush Securities analyst Daniel Ives.

Meanwhile, Elon Musk spoke in favor of removing tariffs with the EU. Speaking via video link at an event of the Italian party "League for Premier Salvini" in Florence, he expressed hope that ultimately, ideally, there would be a zero-tariff situation between North America and Europe, adding that this would be his advice to President Trump.

Since the peak in December 2024, the company's shares have already lost 50% of their value. Additional pressure is created by the decline in demand for electric vehicles and the worsening position of Tesla in the Chinese market.